Can beneficiaries or heirs contest a will during probate?

During the probate process, beneficiaries or heirs may contest a will if they believe it is invalid. This can lead to legal challenges and delays in distributing the deceased’s assets.

Do you own a house if your name is on the deeds?

Having your name on the deeds of a property may give the impression of ownership, however, true ownership involves various legal and financial factors to consider. It’s important to understand the implications before determining if you truly own a house.

How does the probate process work, and how can I avoid it in Florida?

Probate in Florida can be a lengthy and costly process, but there are ways to avoid it. By creating a revocable living trust or transferring assets to a designated beneficiary, you can skip probate and ensure a smoother distribution of your estate.

Should you put your checking account in your trust?

Deciding whether to put your checking account in your trust can be a complex decision. While it can offer benefits such as avoiding probate, it may also limit access to funds during your lifetime. Consult with a financial advisor to determine the best option for your specific situation.

nyc guardianship lawyer

Looking for legal support in navigating the complex world of guardianship in NYC? A NYC guardianship lawyer can provide the expertise and guidance you need to protect your loved ones and ensure their best interests are upheld.

Do beneficiaries pay taxes on trust distributions?

Trust distributions can be a source of confusion for beneficiaries when tax season rolls around. Many wonder if they are required to pay taxes on these distributions. Let’s delve into the intricacies of taxes on trust distributions to clarify any uncertainties.

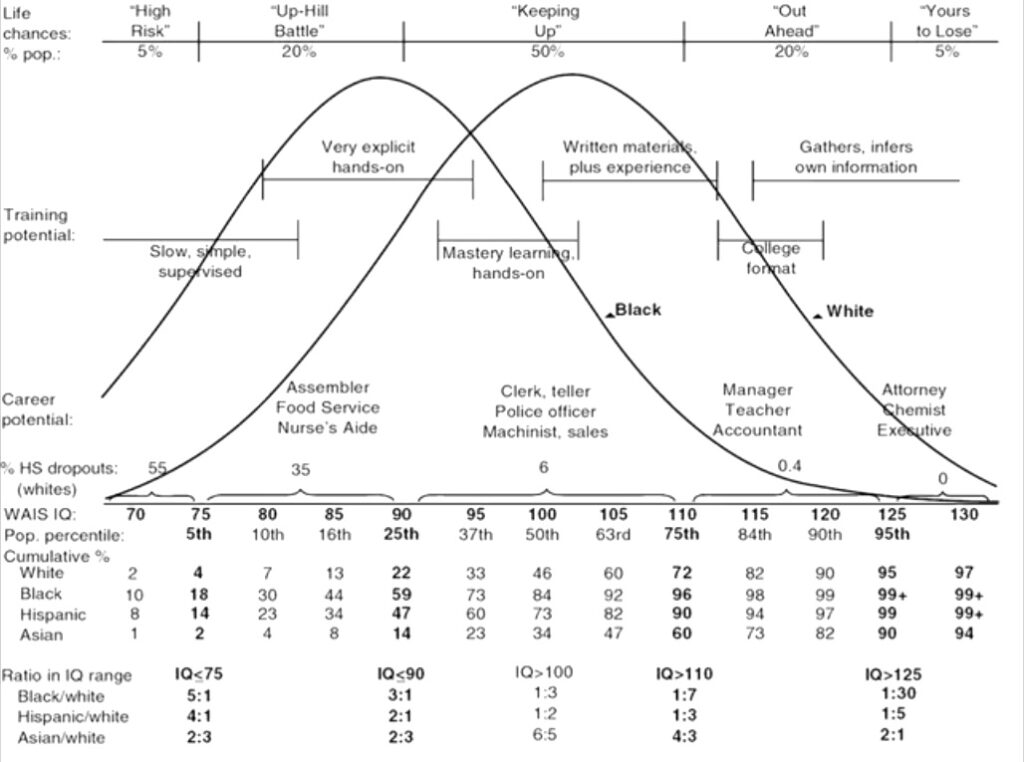

Criminal Justice Reform: Discussions around police reform, sentencing reforms, and the death penalty.

In the ongoing conversation surrounding criminal justice reform, discussions on police reform, sentencing changes, and the abolition of the death penalty continue to spark debate and controversy. As society evolves, so too must our approach to justice.

What is the process for valuing and distributing personal property in my estate?

Valuing and distributing personal property in your estate can be a complex process. It involves determining the fair market value of assets, considering sentimental value, and making decisions on how to allocate items among beneficiaries. Understanding the process is crucial for ensuring a smooth distribution of assets after your passing.

What is the 65-day rule for trust distributions?

The 65-day rule for trust distributions allows trustees to treat distributions made within 65 days of the end of the tax year as if they were made in the previous tax year. This can help minimize tax liabilities for trusts and beneficiaries.

Elder Law in Florida 2024

In the ever-evolving landscape of Elder Law in Florida in 2024, changes are abound. From estate planning to guardianship, staying informed is key for seniors and their families navigating the legal system.