In the realm of financial planning, estate planning often takes a back seat to more immediate concerns like saving for retirement or purchasing a home. However, overlooking estate planning can have significant consequences for you and your loved ones. But what exactly is estate planning, and why is it so crucial? Let’s delve into the world of estate planning to understand its importance and how it can ensure your legacy is preserved for generations to come.

Understanding the Basics of Estate Planning

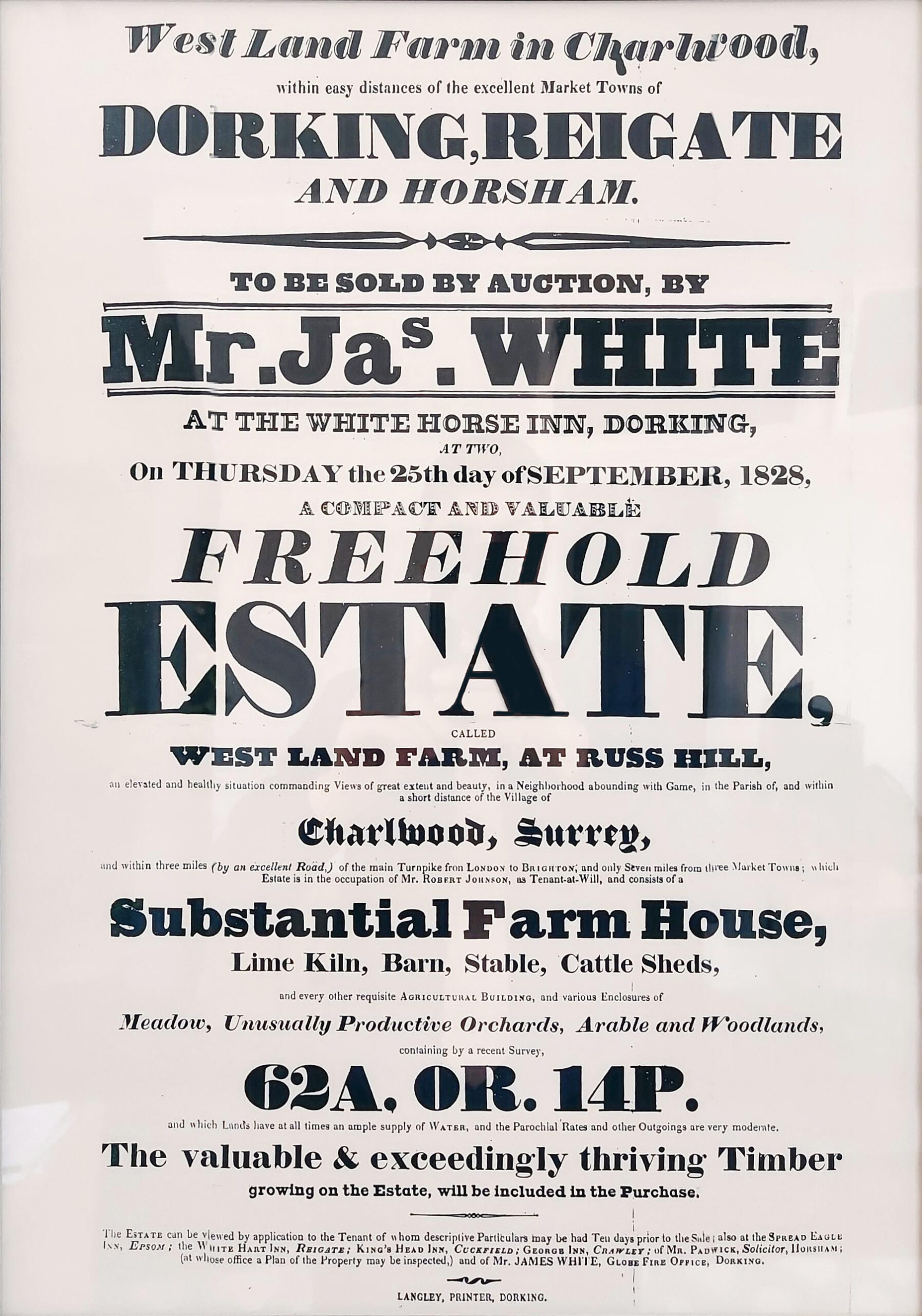

Estate planning is the process of arranging for the management and distribution of an individual’s assets and wealth after their death. This includes making decisions about who will inherit your property, as well as appointing someone to handle your financial affairs if you become unable to do so yourself. By creating an estate plan, you can ensure that your wishes are carried out and that your loved ones are taken care of.

There are several reasons why estate planning is important:

- Protecting your assets: Estate planning allows you to minimize estate taxes and other expenses, ensuring that more of your assets go to your beneficiaries.

- Avoiding family disputes: By clearly outlining your wishes in a legal document, you can help prevent disputes among family members over your estate.

- Planning for incapacity: An estate plan can include provisions for your care in the event that you become incapacitated, ensuring that your affairs are managed according to your wishes.

The Importance of Estate Planning for You and Your Loved Ones

Estate planning is the process of organizing and planning for the management and distribution of your assets after you pass away. It involves creating a will, designating beneficiaries for your retirement accounts and life insurance policies, establishing trusts, and appointing guardians for minor children. It is an essential step to ensure that your wishes are carried out and that your loved ones are taken care of in the event of your death.

Without proper estate planning, your assets may be distributed according to state laws, which may not align with your wishes. This can lead to disputes among family members, unnecessary taxes, and delays in the distribution of your assets. By taking the time to create an estate plan, you can provide for your family, protect your assets, and give yourself peace of mind knowing that your affairs are in order.

Key Components of a Comprehensive Estate Plan

Estate planning is the process of arranging for the management and distribution of your assets after you pass away. It involves making important decisions about who will inherit your belongings, finances, and property. By creating a comprehensive estate plan, you can ensure that your wishes are carried out, minimize taxes, and provide for your loved ones.

include:

- Will: A legal document that outlines how you want your assets to be distributed upon your death.

- Trust: A fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries.

- Power of Attorney: A legal document that grants someone the authority to act on your behalf in financial and legal matters if you become incapacitated.

Strategies for Effective Estate Planning Success

Estate planning is the process of arranging for the management and distribution of a person’s assets upon their death. It involves making key decisions about who will inherit your assets, who will make medical or financial decisions on your behalf if you are unable to do so, and how your assets will be managed and distributed. This process is crucial for ensuring that your wishes are carried out after you pass away and that your loved ones are taken care of.

There are several strategies that can help you achieve effective estate planning success, such as creating a comprehensive will, establishing a trust, and designating beneficiaries for retirement accounts and life insurance policies. It is also important to regularly update your estate plan to reflect any changes in your financial or personal circumstances. By taking the time to create a solid estate plan, you can help protect your assets, minimize taxes, and ensure that your loved ones are provided for according to your wishes.

In conclusion, estate planning is a vital step in ensuring that your assets are distributed according to your wishes after you pass away. By taking the time to put a comprehensive plan in place, you can provide peace of mind for yourself and your loved ones during a difficult time. It’s never too early to start thinking about estate planning, so don’t delay in taking this important step towards securing your legacy. Remember, proper planning now can save your loved ones from unnecessary stress and confusion later on. So, start your estate planning journey today and take control of your future.